Xero - API FAQs

a) How does the BrightPay and Xero API integration work?

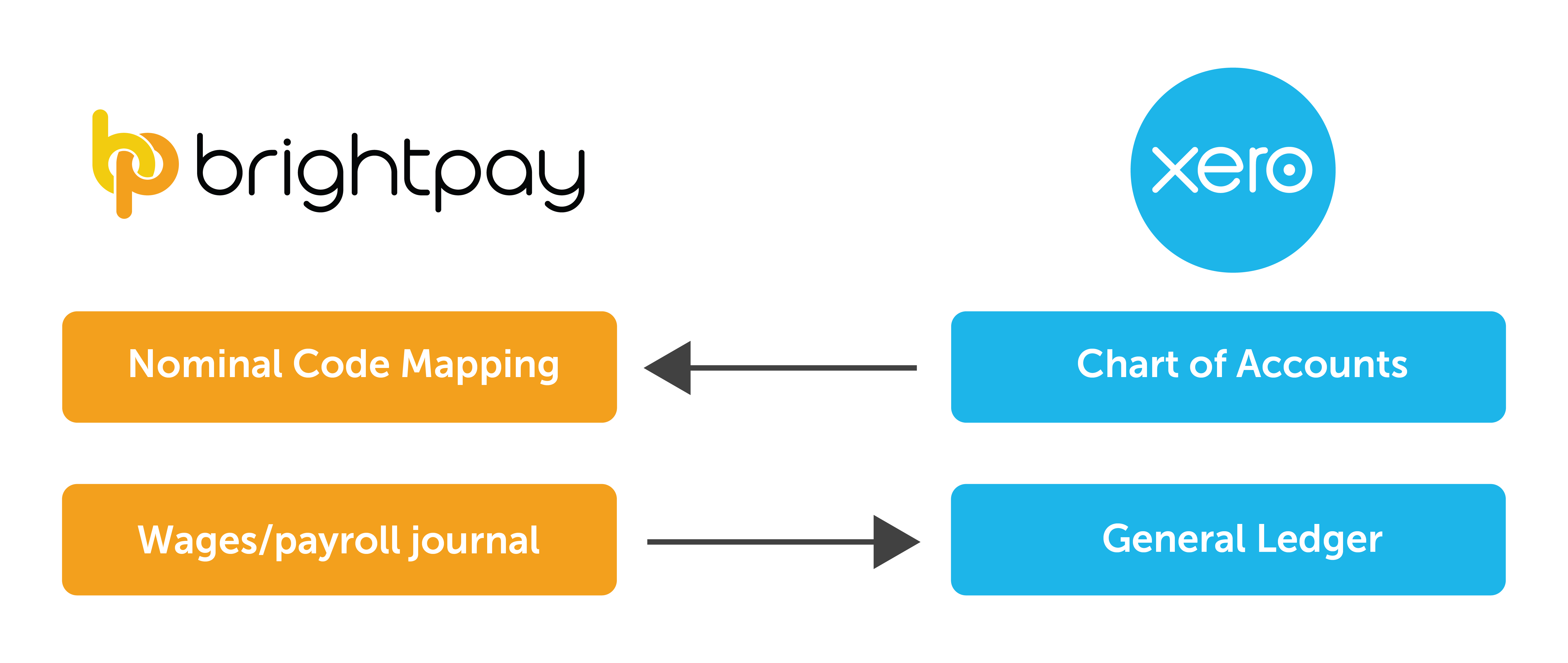

- When you sign into your Xero account in BrightPay, your chart of accounts will be retrieved from Xero

- Using this chart of accounts, map each payroll data item to the relevant nominal account

- Based on the mapping applied, simply submit your journal to Xero

b) How do I create the payroll journal in BrightPay for submission?

- For assistance with submitting your payroll journal from BrightPay to Xero using API, click here .

c) Do I need to send the journal for each pay period separately?

-

No. Based on the date range entered, the journal will include records for all payslips (across all pay frequencies) that have a pay date within the selected range.

d) Can I manually export a CSV file in BrightPay to upload into Xero?

- As well as API, BrightPay also facilitates CSV upload into Xero. For assistance with creating a payroll journal in BrightPay for CSV upload into Xero, click here .

e) How do I view my journal in Xero after submission?

- With Xero, there are two types of access – Standard and Adviser access. To be able to view journals in your Xero account that you submit from BrightPay, you need to be an Adviser.

By default, you will be given standard access. To therefore change your access to Adviser, within your Xero online account:

1) Click on your Company name, followed by My Xero

2) Click on the word Standard, followed by Manage user access

3) Click the three dots, followed by Change Permissions

4) Change your access to Adviser and click Update Permissions to save the change

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.